Everything you need to know about NFTs

Two years ago, the digital artist Beeple sold a piece of his work for an eye-watering $69 million.

Despite the hefty price tag, the new owner won’t be able to proudly display his purchase above the mantlepiece — or anywhere in the physical realm, for that matter. In fact, the only place they will be able to show it off is on their computer screen, as rather than being a physical painting, the art is in the form of a JPEG.

The only problem is, anyone with access to the internet can display the exact same image. If I wanted to save it to my computer, set it as my wallpaper and show all my friends, all I’d have to do is right-click and hit save.

So what did the $69 million purchase grant the new owner? While it doesn’t give them copyright, it does give them the right to display the artwork, titled Everydays: the First 5000 Days, which is currently on show in the Metaverse.

The piece, as the name suggests, consists of 5000 separate pieces of art. Beeple began the project back in 2007 and created one image a day for thirteen years, before collating all the images into the photo above.

He’s since carried on creating one piece a day — some of which are political statements, such as the one below, created in response to the war in Ukraine, depicting Vladimir Putin drowning in blood.

Others are a commentary on modern society, such as the one below drawing attention towards society’s addiction and dependence on social media.

And finally, some of the pieces are just pretty weird.

After all, Beeple isn’t so different to other conventional artists, making statements and judgements through his art, which open to interpretation. It’s just the medium that he chooses to display and sell his art on that is a little different. A little futuristic.

Conventional art, the type we go to museums and galleries to see, fetches millions at auction because they are truly one of a kind. You won’t find them anywhere else in the world in their original form, making their viewing experience unique.

The same can’t be said for NFTs. They lack the exclusivity that normally drives art prices sky-high.

So what is it that made Beeple’s artwork so expensive? And just what is the point of an NFT? Is it purely for bragging rights and showing off exorbitant wealth, or is there something a little deeper that I’m missing?

If you are trying to work out what an NFT actually is, deciding whether you want to invest your hard-earned money in them, or if you simply want to know what “fungible” means, you’ve come to the right place. Here we’ll be covering everything you need to know about NFTs.

So, what is an NFT?

An NFT, or non-fungible token, is a unique, indivisible asset which correlates to a line of code on a blockchain.

I’ll admit, that’s not very clear. So let’s take it step-by-step.

“Fungible” means a commodity that can be easily replaced or exchanged for something of the same nature or value. So, a £20 note is fungible as you can exchange it for £20 worth of goods.

So, in contrast, “non-fungible” refers to an asset that is one of a kind. It can’t be replicated or destroyed and instead, is entirely unique. A trading card is a non-fungible asset as it is one of a kind — it may be in good or bad condition, signed or unsigned, and rare or common. Therefore, the value of each card is different.

A blockchain is a ledger of information where data can only be added. Once it’s on there, there’s no erasing it. It’s designed in such a way as to guarantee trust between users without the need for an authenticating third party. Rather than having one, central point of contact that regulates the blockchain, multiple people are responsible for maintaining it — making it decentralised. The regulators, or moderators, store the data on their devices, keeping it secure across multiple locations.

When you buy your NFT, a data entry is added to the blockchain, declaring your purchase to the world — known as NFT minting. In return for your hard earnt crypto, you get basic ownership rights, as in, you literally own the piece. However, what you don’t get is the copyright of the art — meaning you can’t adapt, reproduce, and in some cases even display it in public. What’s more, if someone steals your NFT (say, by right-clicking and saving the JPEG) and starts posting it on their social feeds, you don’t have the right to sue for copyright infringement.

It’s important to note that only your ownership is stated on the blockchain — the actual NFT itself is typically stored elsewhere, often on a website.

This can pose a serious problem. Anyone that’s encountered a 404 error knows how tumultuous links can be — here one day, gone tomorrow. If a URL that’s hosting your multimillion-pound NFT mysteriously crashes and disappears, that’s an exceptionally expensive IT error.

It’s not too hard to imagine people losing a hefty amount of money this way. If the website owner forgets to pay their hosting bill, or if they intentionally decide to scam you and redirect the URL elsewhere, the actual NFT could be lost forever.

More established artists, such as Beeple or celebrity crypto-fans like Steve Aoki and deadmau5, host their artwork on an InterPlanetary File System (IPFS). This is a little safer than hosting on a URL, as a number of hosts are responsible for keeping your NFT safe, rather than a single domain owner.

However, an IPFS isn’t perfect, and similarly to URLs they often crash themselves. If the system isn’t maintained then the NFT can vanish.

Clearly, the nature of NFT storage makes them a risky investment. So what is it that’s coaxing people into buying them?

What are people using NFTs for?

In 2021, NFTs went meta when Tim Berners-Lee, the inventor of the World Wide Web, sold an NFT of the original source code from 1989 for $5.4 million. Berners-Lee describes it as an “autographed copy of the original code.”

These types of NFTs are particularly appealing to collectors, many of whom believe they will only increase in value. In a similar fashion, a crypto entrepreneur purchased the first-ever tweet, posted by Jack Dorsey, the creator of Twitter. Despite the tweet still being readily available to view on Twitter, the NFT sold for a staggering $2.9 million. Unfortunately for the buyer, who recently attempted to sell it, the value has dropped to a mere four figures.

It’s become alarmingly apparent that people can make NFTs out of just about anything. Back in 2011, Chris Torres created Nyan Cat — a cat flying through space with a Pop-Tart body leaving a rainbow trail behind him, dedicated to his late cat, PJ. As of November this year, the video uploaded to YouTube has over 202,000,000 views. In 2021, Torres created a one-of-a-kind version of the cat into an NFT that sold for $580,000.

Clearly, NFTs have managed to tap into a sense of nostalgia that collectors love and are willing to pay big money for. But if you’re not an extravagant millionaire looking to collect oddities from across the internet, there might still be an NFT for you yet. In the not-so-distant future, you might be purchasing your next home, a concert ticket, or even a Nobel prize-winning scientist’s research, all in the form of an NFT.

Where can you buy an NFT?

You can find yourself an NFT on an online marketplace, the most popular of which is OpenSea. There are nine different types of NFTs available to buy on the site, including art, collectibles, photography, and virtual worlds.

NFT creators can announce an NFT drop in advance, letting would-be buyers in on important information like how many NFTs will be minted and the exact time and date of the launch. Buyers can then snap up the product as soon as it’s available at a low price, in the hope that when scarcity rises, the price will too, so they can sell them on and make a profit.

Some of the genres available on the marketplaces offer a significant degree more functionality than others. For example, crypto domain names are up for grabs, which are unique, scarce, and serve a purpose.

Under the music category, major artists like Snoop Dogg and The Chainsmokers offer exclusive tracks to fans that they can’t find elsewhere.

A more controversial section of the marketplace is the art subset. Digital artists have long struggled to get their dues and have faced relentless plagiarism when they upload their work online. NFTs appear to offer a perfect opportunity for art fans to pay artists what they’re worth. Artists have a unique opportunity to finally earn some real money for their hard work.

However, when you go onto any of the most popular NFT sellers, such as Nifty Gateway, and look at the best-selling NFTs, the top spots are always taken by collectibles. More often than not, they resemble crude little doodles or basic digital art that don’t appear to have a great deal of artistic value — yet sell for thousands, if not millions, of dollars. They’re in collections thousands strong. Usually, a limited amount is made and released, and if you’re lucky enough to get your hands on one in the early days, it might not cost you too much. However, if they sell out and you’re forced to buy from a reseller, you best be prepared to pay more than the average annual salary in the UK for a JPEG of a monkey or an 8-bit avatar.

What is the Bored Ape Yacht Club?

Any article on NFTs would be remiss not to mention the Bored Ape Yacht Club. Launched in 2021, the one-of-a-kind procedurally generated apes were first sold for around $190 apiece. Now, they’re selling for an average of $75,000 — meaning those lucky enough to get in there early can make a huge profit.

Back in October 2021, one bored ape enthusiast handed over $3.4 million for the privilege of owning a furry friend. The high price was attributed to the fella’s collection of unique traits — less than 1% of all Bored Apes have solid gold fur, which apparently makes it worth millions of dollars.

As far as I can tell, the above is just a picture of a monkey. The astronomical price tag and the level of artistic prowess on display don’t add up. If buyers aren’t paying huge prices to compensate for a beautiful piece of art, just what is it that’s luring them in?

The project, developed by Yuga Labs, consists of 10,000 apes living on the Ethereum blockchain. An ape purchase doesn’t just bag the owner a one-of-a-kind cartoon monkey — the token doubles as an exclusive “membership to a swamp club for apes.” Fellow members include Timbaland, Justin Bieber, Jimmy Fallon and Paris Hilton, of which the latter two discussed their apes in an awkward and much-ridiculed Tonight Show segment.

As painful as that clip is to watch, equally cringe-worthy is Eminem and Snoop Dogg’s music video, which sees the pair transform into their Bored Ape avatars.

Yuga Labs took their collection one step further by opening a Bored Ape-themed restaurant, called “Bored & Hungry.” Based out in California, it was the first of its kind to accept cryptocurrency alongside US dollars — giving diners the choice between using Ether tokens or ApeCoins. The fast-food joint launched in April last year, initially as a 90-day pop-up, but due to its overwhelming popularity, it’s here to stay. Bored Ape NFT owners get extra perks when they dine in the restaurant — such as free combo meals and special offers.

The entire site is kitted out in Bored Ape memorabilia — plastered along the walls, packaging, and signs — which interestingly, don’t specifically list the crypto prices for any of the items on the menu. In fact, there’s no mention anywhere in the restaurant of paying in cryptocurrency, and when a Los Angeles Times journalist visited back in June 2022 and asked if they could pay in crypto, they were told no. Andy Nguyen, the restaurant owner, had to pay over $330,000 for the Bored Ape and Mutant Ape NFTs on show, to get the display and ownership rights.

To me, the Bored Ape community is an opportunity for wealthy people to come together, whether that be on Twitter, Discord, or on the official website, and show off which primate picture they paid way too much money for. In fairness to the NFT’s creators, they appear to be self-aware, as they acknowledge on their own website that the online community is probably “going to be full of dicks.”

Is it all just monkeys?

The Bored Ape Yacht Club is just one of many collections of NFTs that garnered a lot of attention in the media — mainly because of their astronomical prices. Thankfully, there are thousands of others out there, invading every cultural realm you can think of. From fashion, music, the gaming industry, real estate, and even science, no industry is safe from the invasion of NFTs.

So let’s dive in.

Designer NFTs

At its core, fashion is about finding your unique identity — a sense of style that you’ve developed and curated all on your own. Different movements within the fashion world, like the Y2K trend, goths, cottagecore, and bohemian, are just a few trends that took the industry by storm. Followers of each aesthetic can find a community of like-minded individuals.

Traditionally, those communities are found in the real world or, in recent years, on social media — at work, out with friends, on Instagram, or even at high-end fashion shows. However, with the rise of Web3, a whole new dimension of fashion is rising up.

Catwalks are out, and the virtual world is officially in vogue.

One of the earliest big brands to join the party was Gucci, whose collaboration with Roblox brought high fashion to the metaverse and gaming in one fell swoop. The virtual Gucci Garden launched in May 2021, and gave Roblox players the opportunity to drift through multiple themed rooms, kitted out in past Gucci campaigns, and gave them the chance to try on and buy digital clothing.

Some fashion NFTs expand further than virtual worlds. Similarly to the Bored Ape Yacht Club, they can grant owners access to exclusive pieces. Warren Lotas, a designer based in LA, launched a line of NFTs in collaboration with the opening of his first studio, which granted holders the chance to skip the lengthy queue, head straight into the store, and access the VIP section of the store, hidden away upstairs. Upon reaching the top of the stairs, you’re greeted by Greeley’s Saloon, an area of the store kitted out with couches, pool tables, and lines of clothing only available to those that snapped up one of the 4000 NFTs released. The Saloon offers a personal experience and a gathering place for those interested in fashion and NFTs — it offers a community.

Even fashion’s most celebrated models are getting in on the action. Bella Hadid, former Model Of The Year and one of the highest-earning supermodels in the world, launched her own line of NFTs titled CY-B3LLA. The collection consists of 11,000 NFTs, released across ten countries, each with artwork designed by local artists in a unique and distinctive style. The art itself features Hadid transformed into a futuristic cyborg, created using 3D scans of the model.

The NFTs were launched on ReBASE, a metaverse site specialising in location-based NFTs. Eventually, owners of a CY-B3LLA NFT can get the chance to meet their idol in real life and in the virtual world, as meet-and-greets are included in the purchase — albeit on an unknown date at some point down the line.

High-end designers thrive due to consumers chasing the premium and exclusive nature of their products. Offering fashion fanatics another avenue to get their hands on some big-name branded gear can boost a company’s profits and provide their loyal customers access to exciting perks.

However, the success of fashion NFTs is closely linked to the success of virtual worlds — which so far, haven’t had a smooth ride. While there are hundreds of online universes available nowadays, the most famous of which — Mark Zuckerberg’s Metaverse — is not having much luck. Despite Zuckerberg pouring investment into what he is desperately trying to convince everyone is the future of the internet, the Metaverse has lost $9.4 billion.

Provided fashion can ride out the highs and lows of both the virtual world and cryptocurrency markets, then NFTs could firmly establish themselves within the industry. With the markets being so volatile, only time will tell.

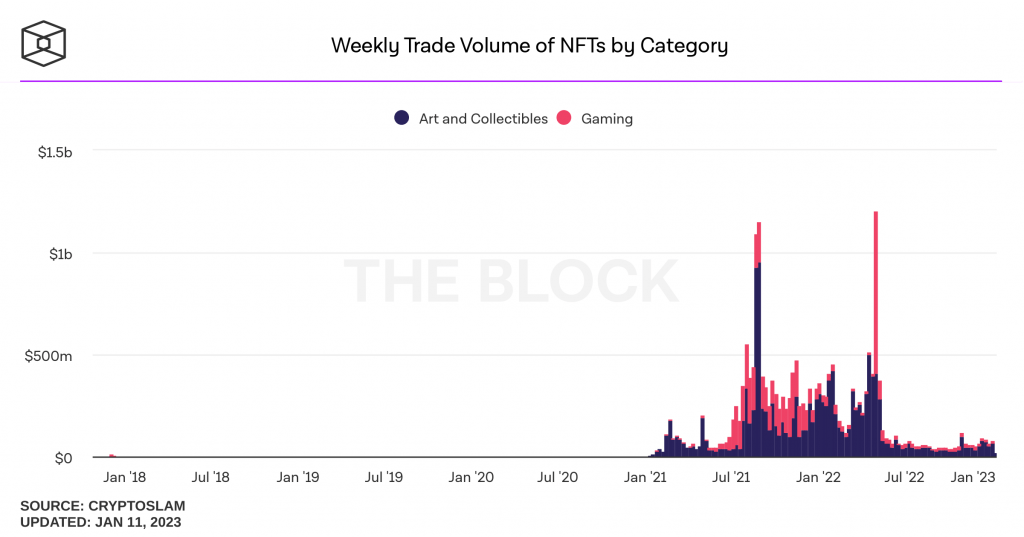

The rise and fall of NFTs in games

One of the earliest adopters of NFTs was the gaming industry. Whether it was through a novel game, designed by NFT creators for NFT collectors, or integration into pre-existing games allowing gamers to collect rare and unique items, NFTs were everywhere in the gaming sphere.

Back in 2017, the blockchain game CryptoKitties was the hottest game on the Ethereum network. Players could purchase, breed, collect and sell virtual cats to other players. The cats themselves don’t actually do anything and are only static images.

Despite the game having no goal or way of winning, it didn’t stop collectors from dishing out thousands of pounds to get their hands on a rare cat. The most expensive cat sold for 600 Ethereum tokens, equivalent to around $390,000, in September 2021. Despite this, when it next went up for auction, the highest bid it received was 0.3 ETH. It’s still up for sale today.

The Miss Purrfect cat, seen in the tweet above, sold for a mere 0.01 ETH — that’s around £10. It would appear that the heyday of collectable games is officially over.

Ubisoft, one of the biggest game developers, wasn’t immune to the lucrative pull of crypto. At the end of 2021, the company launched NFTs in their Ghost Recon Breaking Point game, releasing free drops of one-of-a-kind outfits and weapons that players could use in the game. The kit was tradeable on the NFT marketplaces Rarible and Objkt. However, the unique items sadly weren’t unique enough to convince players to get invested in the NFT lifestyle, and four months later, only 96 trades had been made. Subsequently, Ubisoft canned its venture into NFTs in Ghost Recon.

Gamers are sceptical about NFTs, and with good reason — games don’t last forever, newer versions are released, and once popular games fall to the wayside. No one wants to spend thousands of pounds for an in-game item that will only be used for a matter of months. Furthermore, if NFTs offer players an advantage, lower-income players could be priced out of the game.

In 2021, Steam — one of the largest collections of digital video games — made the decision to ban blockchain games from their platform. Valve, Steam’s parent company, made the decision in light of the volatility of cryptocurrency and questionable business practices happening behind the scenes. The move was widely welcomed by Steam’s users.

While initially promising, NFTs in the gaming industry have failed to launch. Prices have tumbled, and general interest has all but faded away. As it stands, they look unlikely to make a comeback any time soon.

Can NFTs make music profitable again?

Over the past couple of decades, the music industry has been radically transformed. Gone are the days of records, CDs, iPods, and MP3s, as streaming services now dominate the industry.

With streaming, we have access to an unprecedented catalogue of singers, albums, and playlists to explore. However, the artists themselves now have to contend with rock-bottom pay-per-stream figures, with the biggest music streaming platform in the world, Spotify, paying a mere $0.0033 per stream. The digital age has also made it incredibly easy for work to be stolen, leaving the creator without any royalty fees.

As NFTs began to enter the mainstream, some of the biggest names in music, including The Weeknd and Kings of Leon, quickly adopted them. From concert tickets to unreleased tracks, superfans could get their hands on exclusive content — for a price.

The artist Grimes created ten limited edition NFTs featuring gothic illustrations of cherubs wielding weapons with intergalactic backdrops. They were launched in March last 2021 and earnt the star a massive $6 million. The short videos feature original tracks by Grimes, which only NFT holders get the privilege of listening to.

Pop stars have also used NFTs to venture into the Metaverse, with Ariana Grande and Travis Scott both performing concerts in Fortnite, the online multiplayer game that boasts 30 million daily players. A virtual version of Grande performed five shows, all with free admission. Despite the absence of a ticket price, she’s rumoured to have made $20 million from the metaverse gigs.

In a similar fashion, Decentraland, a metaverse that cost over $1 billion to create, monetised the idea, using MultiNFTs — a platform that connects fans with musicians, such as DeadMau5, Soulja Boy, and Paris Hilton — via live events and exclusive content. While the idea quickly rose in popularity at the peak of Covid-19 during lockdowns, the hype appears to have well and truly gone away, with Decentraland reporting a mere 38 daily active users in October last year.

While the industry initially welcomed NFTs with open arms, the appeal seems to have worn off within just a few short years. While the music world has significant issues to overcome in terms of artists getting their dues, NFTs don’t hold the answer to that particular problem. Only the biggest names could afford to delve into cryptocurrency, leaving small up-and-coming artists still struggling to make a living.

Science, NFTs, and morality

Of all the industries to embrace NFTs with open arms, science is, for me, the most surprising. Traditionally labelled as above the fads and trends that sway modern society, concentrating on cutting-edge research with laser focus, science wouldn’t be my first guess as a lover of crypto. Yet NFTs have invaded every corner of the industry, from the biggest organisations like the US Space Force that sold a series of augmented-reality photographs of satellites to research institutes selling Nobel Prize-winning research, NFTs have appeared everywhere.

However, they have come at a cost. Intertwining science and NFTs has opened a line of questioning concerning ethics on pandora’s box-sized proportions. Nebula Genomics, a private company that sequences your DNA, allows people to sell their entire genome, albeit temporarily, to the highest bidder. More often than not, the individuals willing to dish out the most cash are major pharmaceutical businesses that use the data to analyse the population, develop therapies and get ahead of the competition.

While the idea of selling your DNA in the name of making a profit sounds like something out of a sci-fi novel, 15,000 people have already signed up and handed over their genetic data. How much each individual has been paid is unknown, but the question has been raised — are some genomes more valuable than others? If you carry a rare disease, potentially one that scientists haven’t had much opportunity to study, does that make your DNA more valuable than someone else’s?

Furthermore, seeing as we share our DNA with our relatives — whether that’s our parents, grandparents, brothers, sisters, or children, can we really claim full ownership of our genome? And if ultimately we find we can’t, do we still have the right to sell it?

Science certainly isn’t equipped to answer these questions. Nonetheless, George Church, the founder of Nebula Genomics, has ploughed ahead with his NFT scheme. Unsurprisingly, Church isn’t too bothered about the morally-dubious nature of his venture. He’s no stranger to controversy, as he previously planned to launch a dating app based on DNA and has plans to resurrect the woolly mammoth.

Evidently, there is certainly a market for converting scientific research and data into NFTs. Regardless, the ethics concerning selling highly-personal biological information needs to be considered during the creation process — rather than merely being an afterthought.

How real is NFT real estate?

While the bulk of NFTs takes the form of strange artwork or overpriced in-game add-ons, some particularly enthusiastic cryptocurrency fans have taken the interesting decision to dabble in real estate. Brave believers in NFTs can purchase their next home via blockchain real estate — which is exactly what TechCrunch’s founder, Michael Arrington, did back in 2017 when he bought the first blockchain-backed apartment.

Real estate NFTs may be one of the few instances where an NFT is truly worth the huge sums of money people pay for them. However, in typical cryptocurrency fashion, NFT collectors have found a way to waste huge sums of money on digital assets through the introduction of virtual real estate.

People are dishing out millions of pounds to get their hands on plots of land in the metaverse — the supposed future of the internet, despite losing billions every year. Virtual land developers are paying over $4 million to buy land that they believe will only grow in value when (and if) the metaverse takes off.

What’s next for NFTs?

The future of NFTs is far from safe. By the end of 2022, the market was down across every industry, and overall sales have fallen 90% since 2021.

NFTs aren’t the only ones suffering — the entire cryptocurrency sphere is in decline. Bitcoin, the most valuable cryptocurrency available globally, has been in decline since 2021 and isn’t showing any signs of recovery.

As the hype around cryptocurrency and NFTs has died off, scandals like the collapse of FTX Trading, leading to a loss of $8 billion in crypto, have further hampered trading. A spate of hacks and thefts led to the industry losing over $3.87 billion in 2022 alone. Shortcomings in cyber security and the inherently anonymous nature of the currency make it immensely difficult to track down hackers, so the odds of regaining what was taken are slim.

Without a resurgence of crypto prices and trust in the industry, NFTs won’t recover anytime soon.

However, there is a much more fundamental problem that drastically endangers their longevity. The environmental impact of NFTs is incompatible with legally-binding international commitments to control climate change and limit global average temperature rise to 1.5°C.

NFT minting and bidding use a lot of energy. When the artist Joanie Lemercier joined the NFT bandwagon in 2021, he didn’t realise that his NFT drop would use the same amount of energy that his studio used in the previous two years — around 8.7 megawatt-hours of energy. When Lemercier learnt of his sudden spike in energy use, he subsequently stopped trading NFTs.

Most NFTs are traded via the Ethereum blockchain, which made the switch from the incredibly energy-intensive proof-of-work method to proof-of-stake in September last year. Proof-of-work required rigorous trial and error calculations in order to add a block to the chain. On the other hand, proof-of-stake requires users to ‘stake’ a portion of their own crypto to add a block, which is forfeited if they’re found to be acting dishonestly.

Prior to the swap, Ethereum was estimated to use 100KgCO2 to mint a single NFT — the equivalent of a two-hour flight. If the NFT attracts a significant number of bids, that figure rises to 500KgCO2 — the equivalent of a five-hour+ flight.

Fortunately, Ethereum is estimated to have cut its energy use by ~99.95%. While this is a big step in the right direction for NFTs and cryptocurrency, there is still the major issue of cryptocurrencies, such as Bitcoin, that continue to use proof-of-work.

Bitcoin alone uses more electricity each year than Finland, Chile, and Denmark. Its climatic impact is more devastating than the gold mining industry and is on par with natural gas extraction and cattle rearing.

Thankfully, the vast majority of NFT purchases are done with Ethereum tokens. However, some are still bought with environmentally-destructive cryptocurrencies.

Critics of proof-of-stake were quick to point out that only those who already hold vast quantities of Ethereum tokens can engage in the process of adding blocks to the chain. This could lead to the chain becoming more centralised — a feature drastically at odds with the main selling point of cryptocurrency being that it is decentralised.

So, what is the point of an NFT?

To recap, NFTs are a unique, digital asset, which can take the form of artwork, collectibles, virtual real estate, designer attire, and even DNA. Their true value is seemingly less derived from the NFT itself and is instead deeply rooted in the culture and community that surrounds them.

Many NFTs host their own exclusive meeting places, available only for those of us willing to part with thousands upon thousands of pounds for a JPEG.

Despite tumbling prices and dwindling popularity, NFTs continue to remain a club only accessible to the richest among us. Their bafflingly extortionate prices appear to be less of a deterrent and more of an appeal to people with bundles of spare cash to spend.

However, the future of NFTs is far from certain. Between the plummeting value of cryptocurrencies, scams, and general disinterest in the concept, their popularity has fallen rapidly in the past couple of years.

To sign off, I’ll leave with you one of the strangest pieces of news to emerge from the crypto world in 2022: Donald Trump, who in an inexplicable and completely bizarre move, decided to launch his own range of NFTs at the end of last year for the low, low price of $99.

Their remarkable artistic prowess speaks for itself.

In classic NFT fashion, sales have fallen 99% since their launch last December. And in classic Trump fashion, he’s been accused of using copyrighted images in his NFTs.

For better or worse, there’s never a dull moment in the world of NFTs.